New Finance Minister Nhlanhla Nene this afternoon delivered his first major speech to Parliament in his new role.

The 2014 Mini Budget (or Medium Term Budget Policy Statement to give it the official title). This morning Rhodes Professor Matthew Lester worked through all the information in the “lock up”. Here is his assessment.

Page 1 of the 2014 Medium Term Budget Policy Statement concludes:

Matthew Lester: Rhodes Business School professor, tax and financial planning specialist

‘The choice we face in considering these proposals is a difficult one. But we believe that this course can no longer be postponed’ Nhlanhla Nene, Minister of Finance

Pass the Imodium bottle and perhaps some Prozac as well! This could be the start of what the taxpayer has been dreading for years.

Don’t panic quite yet. This is the MTBPS or mini budget. Taxes cannot increase today. The big stuff, if it comes, will be in the main budget in February next year.

South Africa is making a bad habit of changing finance ministers at the very worst moment. Trevor Manuel threw the worst hospital pass in history to Pravin Gordhan when he took over at the beginning of the recession in May 2009.

It must be wonderful to be an economist. There seems to be so little consequence when they are wrong. The world followed the work of economists such as Reinhart and Roggoffs ‘ the aftermath of financial crisis, 2009’ predicting that there would be a speedy recovery from the recession. It just didn’t happen.

South Africa’s economic prosperity is heavily linked to the world economy. So Pravin Gordhan’s days as minister of finance were spent trying to coax RSA through bad times in the hope of accelerated growth rates and higher tax collections.

In the 2012 National Budget Speech PG predicted that GDP would increase from 2,7% in 2013 to 4,2% by 2015. Not many would have disagreed with that at the time.

No such luck.

Page 1 of the 2014 MTBPS statement released today reads’ This year we anticipate GDP growth of 1,4%. While growth is expected to reach 3% in 2017.

Nowhere is a 4% growth rate even on the radar.

Some get angry when our misfortunes of today are blamed on our past. When it comes to the RSA tax system I am not one of them.

RSA under apartheid never built a social security system. So we never implemented social security tax ’SST’. In many countries within the OECD personal income tax ‘PIT’ plus SST contributes 50% of the tax collection. This lessons the burden on corporate tax collections ‘CIT’ which are highly volatile in tough times.

Since 2009 RSA has continued to try and make ends meet with three major taxes PIT, CIT and VAT contributing over 80% of total tax collections. It hasn’t worked and today we have accumulated R1,2 trillion in national debt since the glory Manuel days of 2008. It cannot continue at this rate. The big question today was ‘will Nene confront the stark reality?’

The 2014 MTBPS acknowledges this..

‘Fiscal consolidation can no longer be postponed. Ensuring continued progress towards a better life obliges government to safeguard the public finances by acting within fiscal limits. To do otherwise would risk exposing the country to debt trap, with damaging consequences for development for many years to come.’

The options

So now Nene takes the helm. And the question is ‘Is the game plan changing?’ Will Nene

make the move to increase PIT, CIT or VAT?

Or look for another major tax?

Or will he attempt to curb government expenditure?

Or does he kick for touch and accept the associated increase in national debt?

These are the same issues that confronted PG for 5 years. PG is a kind man and he kicked for touch.

Tax increases

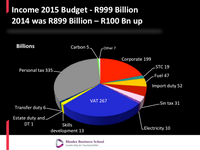

Back in February 2014 the budgeted tax collection for 2014/15 was set at R999 billion. This has now been revised downwards by R10billion, resulting in a forecasted budget deficit of 4,1% of GDP. That’s an uncomfortable level. In 2011 PG forecast that RSA would be down to 3,3% by now.

If SARS is within the R10 billion target that is a major achievement given the reduced growth rates. But remember that the lion’s share of tax collections arrive in the second half of the fiscal year. Much could still change by February.

Tax collections budgets for 2015/16 have been dropped by R19 billion for 2015/16 and R32 billion for 2016/17.

The 2014 MTBPS does not give much away on tax reform simply stating that the Davis Tax Committee recommendations will be tabled in the February 2015 National Budget Speech.

New taxes such as Carbon Tax or National Health Insurance are still some way off in the legislative process. Carbon tax is still on the radar for 2016, but it will probably be postponed again. NHI deductions on pay slips are still years off.

Judge Dennis Davis remains adamant that the RSA tax system has achieved a great deal. Yes, there are always changes that can help. But these are tweaks rather than Control- Alt- Delete’s.

There is no indication in the MTBPS numbers of the taxpayer being expected to carry the can alone. This is just fantastic news.

Government expenditure

Of some comfort is that current year government expenditure is R6,2 billion below target.

But the national debt is still growing at an alarming rate and debt service costs are increasing faster than the national budget as a whole, reaching R150 billion by 2017/18.

Government expenditure proposals have been reduced by R10 billion for 2016/17 and R15 billion for R2016/17. This might appear insignificant in the context of total budgeted expenditure of R1,2 trillion but the important point is the burden is not being placed on the taxpayer.

For example, to collect this amount by increasing the maximum marginal tax rate for PIT, the rate would have to exceed 45%. Or the VAT rate would have to be increased by 1%

National treasury has identified R45 billion in unallocated services. These funds will now act as a fiscal buffer, though a portion may be used to fund high impact programmes.

Government will now make a concerted effort to finance part of its capital budget from savings rather than borrowing. In this way it forecast that RSA’s total national government debt will stabilize at around 45,9% of GDP by 2017/18. Without the intervention the debt trajectory was on its way towards 50% of GDP.

Consolidated government expenditure will increase by a nominal 7,6% over the 2014 -2018 period. That’s very conservative if inflation lurks around 6%. The only question is ‘are we spending enough to achieve the objectives of the NDP?

The MTPS does carry the stern warning that if the world economy worsens additional measures may be required. So a lot still hangs in the balance.

Conclusion

There’s no need to overdose on Imodium or Prozac today. The shockers, if they do come, will be in the National Budget Speech next year.

The unknown of today is will the sovereign debt rating agencies accept that the adjustments are enough to curb the national debt trends. Only time will tell.

There is good reason to celebrate. But it is less obvious than meets the eye. Indulge me please.

Following the death of Mandela I had three great leaders in my life; minister of finance, Pravin Gordhan, Reserve Bank Governor, Gill Marcus and Rhodes University Vice Chancellor Saleem Badat.

They were all fantastic managers, committed to the ideals of the struggle and never tainted by the gross excesses that feature so prominently today. It has been a privilege to work with all of them. In the space of a few months they all moved on. This created the potential vacuum on which things can go horribly wrong.

Pravin Gordhan never let politics get in the way of sound economic policy. He was a strong character. He was a legend for being able to say ‘NO!’.

There was always that doubt that Gordhan’s successor would be dominated by the politicians and instructed to place a higher burden on the taxpayer or just increase national debt until RSA disappeared into oblivion.

In todays mini budget Nene has displayed the sheer guts required to be a good minister of finance. He didn’t kick for touch or take the easy ways out. He has attacked the fundamental issue – RSA is spending to much.

Gordhan, Marcus and Badat have left fantastic legacies of highly competent successors and management teams that can continue their good work. I am totally comfortable with facing the future with Finance minister Nhlanhla Nene, Reserve Bank Governor Lesetja Kganyago and Rhodes Vice Chancellor Sizwe Mabizele.

Now that’s what transformation is all about.

By Matthew Lester

Article Source; http://www.biznews.com