A director of a listed company, exhausted by multiple SARS audits, recently complained to me that big companies are overly targeted by SARS. So here is an explanation.

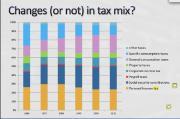

The decline the relative contribution made by companies ‘CIT’ is often overlooked, declining from 22.9% in 2009/10 to 19.9% in 2013/14. Reduced CIT collections resulted in a higher relative contribution by Personal Tax ‘PIT’ . The contribution of PIT to total tax revenue was 34.5% in 2013/14. The extent of the shift is shown by the fact that while PIT contributed only R28.9 billion more to tax revenue than CIT in 2008/09 it provided R131.4 billion more than CIT in 2013/14.

For the 2012 tax year there were only 552 companies in RSA reporting taxable income of over R100 million per annum out of 625808 that submitted returns. That’s 0,1% of companies.

But the 552 companies paid 64% of CIT! That’s 12,8% of total tax collections. This may look shocking but the number is up from the 485 reflected in the SARS tax package of 2013. So there is hope.

So if SARS is doing its job properly they will concentrate on the big money.

The OECD argues that the big corporates are the taxpayers with rafts of tax nerds that can make huge damage to the tax system. Hence we see the current war against “BEPS” (Base Erosion and Profit Shifting). This goes further into society to the extent that we get Archbishop of York stating ‘It is sinfull… actually they are robbing God!’

The crisp question is ‘will stamping out tax evasion solve the world’s tax problems?’

Figures released by the OECD reflect the international tax mix.

Corporate tax only represents about 10% of the tax mix. So companies can never carry the world’s problems.

Have the tax nerds come up with new schemes that are suddenly threatening the world?

No! There has been no quantum change in corporate tax collections. The decline in corporate tax collections is far more affected by the aftershocks of the global financial crisis.

But isn’t it a lovely scapegoat for politicians and trade unions to blame under delivery on corporate taxpayers. That one learns in Politics 101.

Article by : Matthew Lester.

Article source : BizNews